Informal players propose tiered system for taxation

Martin Kadzere THE Confederation of Zimbabwe Retailers (CZR) has proposed a three-tier presumptive tax system for micro, small and medium enterprises (MSMEs) to address the growing level of informalisation in the economy and to offer a fair and equitable tax regime for small businesses contributing to the fiscus. The proposal, submitted to Finance, Economic Development […]

Martin Kadzere

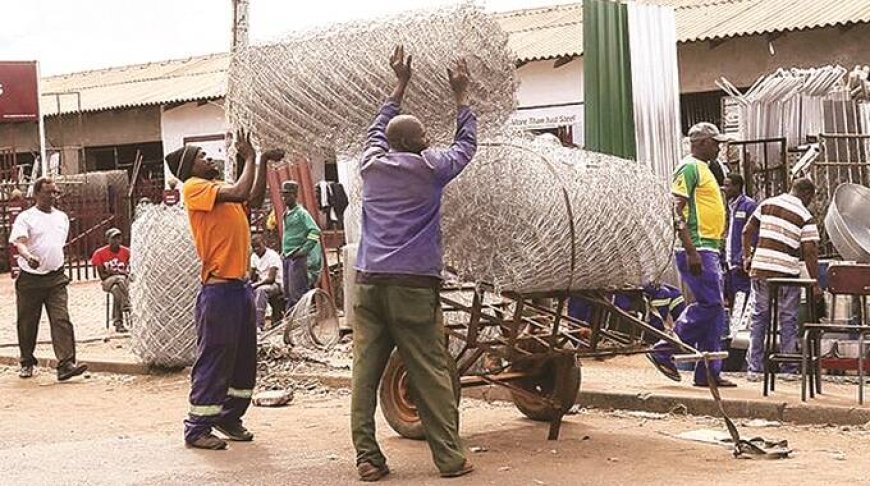

THE Confederation of Zimbabwe Retailers (CZR) has proposed a three-tier presumptive tax system for micro, small and medium enterprises (MSMEs) to address the growing level of informalisation in the economy and to offer a fair and equitable tax regime for small businesses contributing to the fiscus.

The proposal, submitted to Finance, Economic Development and Investment Promotion Minister Professor Mthuli Ncube recently, highlights the urgent need for a structured taxation approach that categorises MSMEs into distinct tiers based on factors such as business size, turnover and number of employees.

By harnessing the growing informal sector, CZR believes the country can strategically integrate MSMEs into Zimbabwe’s broader economic development plans.

The CZR proposal comes as the latest Government data for August shows that the Treasury managed to collect only ZiG$35 million in presumptive tax revenue between January and August this year against a target of about ZiG 1,2 billion.

According to the Zimbabwe National Chamber of Commerce’s State of Industry and Commerce survey of 2023, a significant 71 percent of Zimbabwean businesses operate informally, placing an undue tax burden on the few formalised businesses.

The first tier, covering MSMEs with annual turnover of up to US$15 000, includes businesses like small tuckshops and market stalls.

These businesses, characterised by smaller daily sales and limited operational capacity, would be subject to an annual presumptive tax of US$500.

The second tier encompasses medium-scale MSMEs with annual turnovers ranging from US$15 000 to US$50 000.

The businesses, including large tuckshops and small stores, have higher daily sales, employ more staff and operate at a larger scale. To reflect their increased capacity, they would be subject to an annual presumptive tax of US$1 500.

The third tier encompasses large-scale MSMEs with annual turnovers ranging from US$50 000 to US$100 000.

The businesses, which may include larger tuckshops and partitioned mall stores, operate at a significant scale, with bigger premises, more employees and higher sales. To reflect their increased capacity, they will be subject to an annual presumptive tax of US$3 000.

The proposed system is adapted from a successful model implemented in Tanzania, which brought over 40 percent of informal businesses into the tax net, according to the CZR.

The initiative, it says, significantly contributed to the revenue of Tanzania and stimulated formalised economic growth.

“This three-tier presumptive tax structure promotes fairness and sustainability, ensuring MSMEs contribute to the economy in a manner that aligns with their financial capacity while simplifying tax compliance,” said CRZ.

To further streamline tax compliance, CRZ proposes integrating Value-Added Tax (VAT) into the presumptive tax model. Businesses under the three-tier system would collect VAT from customers at a reduced rate, accounting for VAT exemptions on specific goods.

The collected VAT would then be remitted as part of the presumptive tax payment. This integrated approach simplifies the tax compliance process by eliminating the need for separate VAT and presumptive tax systems, reducing costs for both businesses and the Zimbabwe Revenue Authority (ZIMRA).

“By harnessing the growing informal sector through this tiered presumptive tax system, the Government stands to generate significant revenue.

“Our estimates suggest that, initially, Harare’s central business district (CBD) alone could generate over US$50 million annually through the successful implementation of this system. As the system is expanded to other provinces, total national revenue could increase up to US$200 million annually,” says CRZ.

Given the significant economic activity in Harare’s CBD, it would serve as an ideal testing ground for the proposed presumptive tax system.

If successful, the model can then be rolled out in other urban centres across the country, adapting to the specific needs of each province.

With the cooperation of ZIMRA and local authorities, CRZ says the system can be customised to suit diverse economic landscapes while adhering to its core principles of simplicity, fairness and inclusivity.

It says it is uniquely positioned to mobilise MSMEs across the country towards this proposed taxation criterion.

Its extensive network across the informal retail trading sector allows it to identify and engage with operators, small stores and other informal business owners.

With the Government’s support, CZR says it can facilitate the implementation of the presumptive tax system, ensuring that all MSMEs contribute to national growth while benefitting from formal economic inclusion.

It proposes to work closely with ZIMRA to provide the necessary guidance and support to MSMEs, simplifying the registration process and ensuring tax compliance.

“The Confederation of Zimbabwe Retailers firmly believes that the introduction of a presumptive tax system tailored to MSMEs will greatly enhance Zimbabwe’s tax revenue while fostering the growth of small businesses.

“By incorporating best practices from Tanzania and addressing the specific needs of Zimbabwe’s informal sector, we can create a tax system that is fair, efficient and conducive to economic development.”

A study by University of Zimbabwe researcher Curren Pindiriri estimates that informalisation cost the Treasury approximately US$1,15 billion between 2020 and 2023. Minister Ncube has repeatedly highlighted the risks to revenue collection posed by high levels of informalisation.

The Zimbabwe Industrial Reconstruction and Growth Plan, a short-term transitional manufacturing policy document, has also highlighted the challenges associated with informalisation.

The document proposes that the country should accelerate the adoption of simplified tax models for small and medium enterprises (SMEs) and expedite the development of a formalisation strategy to broaden the tax base, as outlined in a new Government policy document.

“The apparent challenge with this scenario (informalisation) is that the few formalised businesses carry the tax burden for those who are not compliant.

“This is an undesirable trend and measures are needed to prescribe simplified registration and minimum mandatory licensing requirements that promote formalisation, through the Shop Licensing Act.

“The adoption of simplified tax models for SMEs will be pursued with a view to widen the tax base,” says the policy document.

What's Your Reaction?