Zimbabwe’s insurance sector adapts to climate change

Tawanda Musarurwa ON OCTOBER 9 this year, Lands, Agriculture, Fisheries, Water and Rural Development Minister Dr Anxious Masuka posed a curious question to the crowd: “What is the Shona word for insurance?” The gathering paused, hesitant. After a few guesses, one suggestion, “tsivatsaona”, resonated the most. It was a telling moment. Even though insurance companies […]

Tawanda Musarurwa

ON OCTOBER 9 this year, Lands, Agriculture, Fisheries, Water and Rural Development Minister Dr Anxious Masuka posed a curious question to the crowd: “What is the Shona word for insurance?”

The gathering paused, hesitant.

After a few guesses, one suggestion, “tsivatsaona”, resonated the most.

It was a telling moment.

Even though insurance companies have operated in Zimbabwe for decades, the concept has yet to embed itself in the vernacular, especially among smallholder farmers, a group historically overlooked by the sector.

Despite this, efforts to bridge this gap are well underway.

Over the last few years, the Government, in collaboration with the Insurance and Pensions Commission (IPEC), the International Finance Corporation (IFC), FSD Africa, the Access to Insurance Initiative and local insurers, have developed a new initiative aimed at addressing the insurance needs of smallholder farmers. Dubbed the “Farmers’ Basket,” this initiative seeks to extend agricultural insurance to rural communities that have long been left behind.

The crowd gathered at Goromonzi Country Club in Mashonaland East province marked the culmination of the Farmers’ Basket project, which has introduced innovative solutions to protect smallholder farmers from the growing unpredictability of Zimbabwe’s weather patterns.

The province is a microcosm of the country.

Covering an area of 32 230 km2, Mashonaland East province has both wet and drier districts, and is therefore variably vulnerable to the effects of climate change.

Its nine districts: Chikomba, Goromonzi, Marondera, Mudzi, Mudzi, Murewa, Mutoko, Seke, Uzumba-Maramba-Pfungwe and Wedza hold a population of around 1,73 million, according to the 2022 National Census.

The country’s insurance sector regulator has been pushing for the development of parametric insurance products, which essentially go beyond the limitations of traditional insurance products insofar as they cover the probability of a predefined event happening and pay-out according to a predefined scheme.

Said IPEC public relations manager Mr Lloyd Gumbo.

“We are playing a facilitator role. One of our mandates as a regulator is to develop the local insurance and pensions industry, and we look at opportunities that are available for our sector.

“The issue of climate change is a global problem, so for us to help the farmers we want insurance to play its role in terms of risk mitigation.”

In 2021, IPEC successfully applied to participate in Access to Insurance Initiative’s Third Inclusive Insurance Innovation Lab (2021-2022), which sought to develop innovative solutions to tackle climate change.

Other countries whose application was successful were Costa Rica, Zambia and Grenada.

Farmers’ Basket was born out of this initiative.

A multi-pronged approach to agricultural insurance

Farmers’ Basket, according to IPEC, is designed to protect farmers from a range of risks, including early and late dry spells, as well as multiple production challenges that could significantly reduce yields.

The insurance combines two models: weather index insurance and area yield insurance, both of which provide a safety net for farmers.

For weather index insurance, payouts are triggered when farmers experience dry spells, with satellite data providing the basis for monitoring.

Under the area yield model, if the average yield in a given area falls below a pre-set trigger level, farmers receive a payout based on crop-cutting experiments.

“We combined both the area yield and the weather index models to see what works better for Zimbabwe,” said Mr Gumbo.

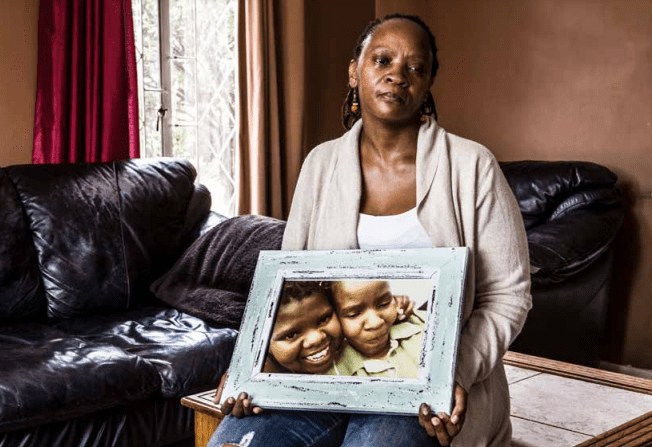

During the pilot phase in Goromonzi, 1 800 smallholder farmers out of the 4 014 who had initially registered paid a once-off premium of US$15.

Of those, each received a payout of US$65 after an agricultural season impacted by the El Niño phenomenon.

Although the payout benefited just 45 percent of the targeted participants, the project’s potential for expansion is undeniable.

The Government aims to scale up the initiative to serve more farmers across the country.

In a bold move, the Government has also proposed linking the Farmers’ Basket to its nationwide Pfumvudza/Intwasa agriculture inputs scheme, which currently benefits around 1,6 million smallholder farmers.

Additionally, authorities have committed to subsidising insurance premiums to make the programme more accessible.

“The success of this pilot project demonstrates the potential for scaling up agricultural insurance and enhancing the economic stability of rural communities across the country.

“We recognise the importance of easing the financial burden on our smallholder farmers, and as such, the Government is ready to subsidise insurance premiums for smallholder farmers,” said Finance, Economic Development and Investment Promotion Minister Professor Mthuli Ncube during the Goromonzi event.

Collaboration

While extending agricultural insurance to smallholder farmers has been a longstanding challenge for local insurers, climate change had added unique challenges for the industry, not least increasing the scope of the problem.

This has necessitated insurers to collaborate.

To facilitate the Farmers’ Basket initiative, short-term representative body, the Insurance Council of Zimbabwe (ICZ) created a consortium – Special Risks Insurance Consortium (SRIC) – of short-term insurance and reinsurance companies to insure the farmers.

The agro-pool is aimed at providing insurance to previously uninsured smallholder farmers, through a weather-indexed agriculture insurance model, starting with the Goromonzi district pilot project.

According to the 29-member ICZ, the weather-indexed crop insurance is being offered under the agro-pool within the SRIC, which is managed by the ICZ.

“The SRIC houses pools that collectively insure special risks, which by their nature cannot be insured by individual insurers,” said ICZ chairperson Mr David Nyabadza.

But, going forward wider collaborative efforts are required.

“To build the required national resilience, we are actively engaging with key partners, such as key Government ministries, FSD Africa, IFC, AfDB, and the World Bank, to explore innovative solutions like the weather-indexed insurance for climate- resilient agriculture to cover various crops and livestock as well as smallholder farmers training and awareness programmes on risk management and insurance,” added Mr Nyabadza.

Climate change-related disasters tend to be expansive, and this necessitates spreading the financial burden across multiple entities, making it more affordable and sustainable for insurers to offer coverage.

Examples include regional initiatives such as the Caribbean Catastrophe Risk Insurance Facility (CCRIF).

Scaling climate resilience

While the Farmers’ Basket initiative addresses agricultural vulnerabilities, the Government has taken further steps to harness insurance as a broader tool for combating climate change.

Zimbabwe recently entered into a sovereign risk insurance agreement with African Risk Capacity (ARC), resulting in a US$16,8 million payout to the Government.

Additional payouts of US$6,1 million and US$8,9 million were made to United Nations (UN) agencies and other humanitarian organisations like the Start Network, bringing Zimbabwe’s total payout to approximately US$32 million.

This insurance payout will significantly bolster Zimbabwe’s disaster response and resilience-building efforts, particularly in agriculture, a sector that employs over 60 percent of the country’s workforce.

The partnership with ARC is part of Zimbabwe’s broader strategy to mitigate the impact of climate-induced disasters, from droughts to floods, on its population. According to the Zimbabwe National Statistics Agency (ZimStat), 70 percent of the population relies on rain-fed agriculture, making such insurance measures crucial in safeguarding livelihoods.

Moreover, the country’s vulnerability to climate change is well-documented. The United Nations reports that Zimbabwe is one of the most climate-affected countries in Southern Africa, with increasingly unpredictable weather patterns wreaking havoc on both urban and rural economies.

Recent data from IPEC underscores the need for insurance reform: in 2022, less than 3 percent of the rural population had access to any form of insurance, highlighting the critical need for initiatives like the Farmers’ Basket.

As Zimbabwe grapples with the evolving realities of climate change, initiatives like the Farmers’ Basket and the ARC partnership offer hope.

They not only provide financial protection, but also equip communities with the tools to adapt and rebuild, ensuring the future resilience of Zimbabwe’s agricultural backbone.

What's Your Reaction?